Marriott, Hyatt, IHG, Choice Hotel, Hilton, Wyndham, Best Western you have a problem. The problem and winners are Airbnb and Boutique Hotels.

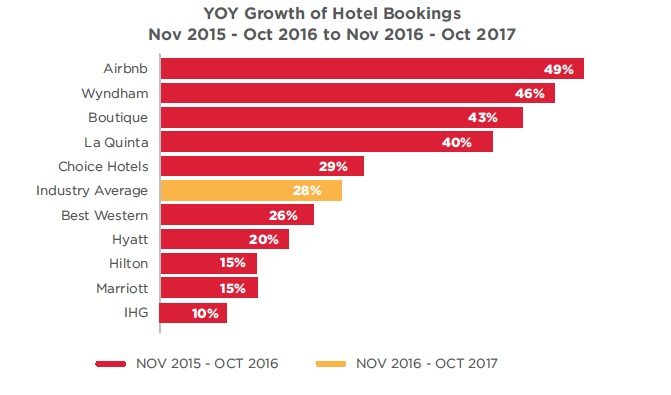

Over the past few years, the hotel industry has rapidly changed. The number of bookings through Airbnb increased 49% from Nov 2015 – Oct 2016 to Nov 2016 – Oct 2017, while the industry average was just 28%. During the same time, bookings at boutique hotels grew 43%.

The data was released by 1010data who revealed that the two biggest challenges currently facing the hotel industry are:

- Rise of Boutiques & Airbnb

- Growth of OTA (online travel agency) Bookings

Technology has improved, providing travelers with better access to booking, check-in and payments. Travelers are after more affordable and authentic options when booking a place to stay. And while this industry is still growing at 28% YOY, the growth of large hotel groups is decelerating. Major players, like Marriott-Starwood [MAR], Hilton [HLT], Hyatt [H], [IHG], Choice Hotels [CHH], Wyndham [WYN], Best Western and La Quinta [LQ], aren’t just competing with new hotel brands, but also with increasingly popular vacation rental providers.

As a result, creating mobile apps and sophisticated websites has been crucial to maintaining a competitive edge in this industry, but it’s not the only thing. They are also trying to reclaim share from online travel agencies (OTA) by encouraging customers to book direct.

Based on 1010data’s findings, the two biggest challenges currently facing the hotel industry are:

1. Rise of Boutiques & Airbnb

2. Growth of OTA Bookings

RISE OF BOUTIQUES & AIRBNB

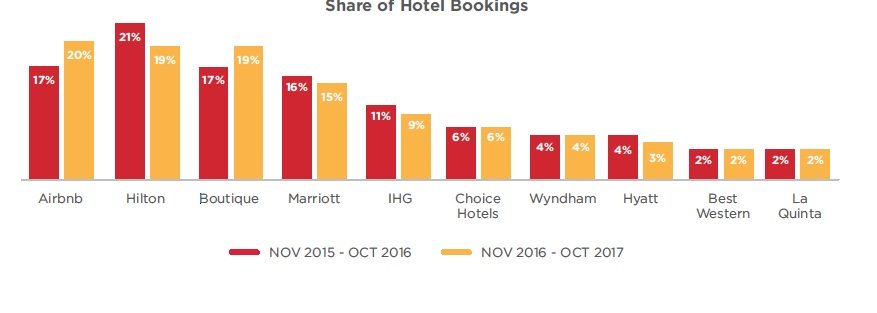

Traveler interest in “authentic” local experiences appears to be increasing. The number of bookings through Airbnb increased 49% from Nov 2015 – Oct 2016 to Nov 2016 – Oct 2017, while the industry average was just 28%. During the same time, bookings at boutique hotels grew 43%. When comparing the share of bookings year over year, Airbnb surpassed all hotels for the first time and boutiques caught up to Hilton.

These trends indicate that travelers are seeking places that feel more like “home” and leaving major hotels for the intimate experience that an Airbnb or a boutique can provide. Across all large hotel groups, between 6 and 10% of lost customers ended up booking an Airbnb in the following year, while between 14 and 22% ended up booking at a boutique in the following year. For example, 8% of Marriott’s lost customers booked with Airbnb in the following year. Roughly 20% to 30% of hotel chains’ lost customers are staying at boutiques and Airbnbs the following year, but between 12 and 18% of lost customers are booking at another hotel group instead. Hotels should combat the pressures of growing traveler interest in boutiques and Airbnbs but also develop strategies to tackle competition from other large hotel groups. The remaining percent of lost customers are not booking hotel stays online in the following year.

Are loyal customers helping this shift? Not exactly. When looking at travelers who make 4+ bookings during a given 12-month period, the data shows that most active travelers aren’t loyal to any option. For the purpose of this analysis, loyal travelers are those who had 80% or more of their bookings with one category (Airbnb, Boutiques or Hotel Groups). The share of unloyal active travelers has grown 4 share points year over year. As a result, hotel loyalty has taken a direct hit. And while hotels still have more loyal customers than boutiques and Airbnbs, loyalty at boutiques is growing as hotel loyalty declines. This trend is similar for travelers who make 1-3 bookings in a given year. The chart focuses on travelers who made 4+ bookings because they represent 65% of all bookings made between Nov 2016 and Oct 2017.

GROWTH OF OTA BOOKINGS

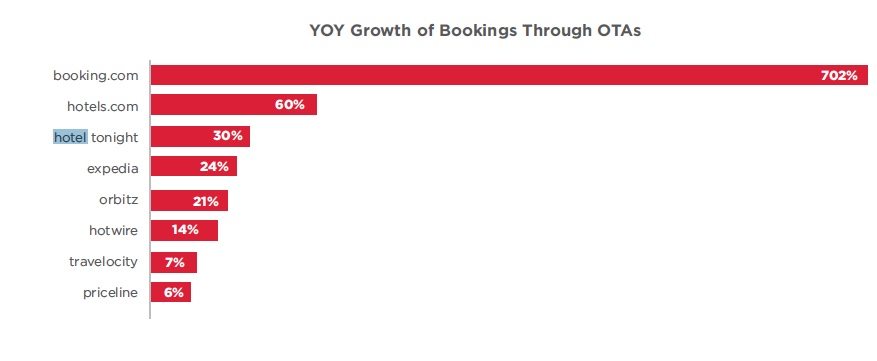

Although hotel groups embraced partnerships with OTAs for years as online bookings increased, hotels are increasingly pushing travelers to book direct. Marriott and Hilton launched campaigns in 2015 that promised travelers their websites would always have the best prices. The industry is trying to discourage travelers from price shopping, since OTAs make that much easier for travelers. Despite these efforts, OTA bookings are rapidly increasing. The number of hotel bookings through OTAs has grown 43% from Nov 2015 – Oct 2016 to Nov 2016 – Oct 2017. In fact, 44% of all hotel bookings online are done through an OTA, which is up from 38% in the prior year.

The rate at which individual OTAs are growing varies greatly. Established sites, like Priceline, Travelocity and Hotwire, are growing 10% year over year. Relative newcomers are growing faster. For example, the number of bookings made through booking.com increased 7x. Hotel Tonight grew 30% YOY.

CONCLUSION

The hotel industry is under immense pressure to keep prices competitive. OTAs give travelers the opportunity to price shop, which forces hotel chains to adjust prices based on a broader competitive base. On top of that, Airbnb prices are based on what the host wants to charge and aren’t tied down to federal regulations in the same way as hotel groups. OTAs and Airbnb bookings are growing 43% and 49%, respectively, which means hotels need to act fast. Travelers expect a more authentic experience and are able to shop around within minutes to find the best option for their budget. Based on the data, hotels are still growing, but need to be aware of how these competitors are trending in order to remain ahead of the curve